Message to Shareholders

Extracted from Annual Report 2023

Dear Valued Shareholders,

On behalf of the Board of Directors ("the Board") of Sealink International Berhad ("the Group"), I am pleased to present a year of commendable performance as the Group continues its growth momentum for the financial year ended 31 December 2023 ("FYE 2023"). The Group recovered from a gross loss of RM4.5 million in FYE 2022 to a record gross profit of RM20.9 million in FYE 2023.

In the ship chartering business, the demand for offshore support vessels ("OSV") has been elevated by the pickup of activity in the oil and gas ("O&G") industry and from the rising oil prices. The Group witnessed a surge in utilisation rates and average charter rates. At the same time, the Group's shipyard operations continued to experience stronger demand for its ship repair services due to an expansion in our customer base. This is evidenced by the significant growth in operational performance.

Our core business, which supports the O&G sector, benefited from both the surge in exploration and production capital expenditure ("capex") in the O&G sector and the increased activity in the marine sector. With the O&G sector having strongly rebounded from its decline over the past number of years, we are poised to leverage on our industry experience and credible track record to compete for more charters.

MARKET OVERVIEW

Based on the recent release of the Petronas Activity Outlook 2024-2026 ("PAO"), the activity outlook for Petronas remains positive, in line with the continued recovery that we have seen throughout 2023. Specifically, Petronas mentioned that this is positive for activities relating to repair and maintenance activities required to maintain the integrity of offshore facilities. With this, the demand for OSVs is expected to remain steady going into 2024, especially for vessels supporting drilling and wells projects. It sees higher demand of OSVs in 2024-2026 compared with its previous forecast and this is an opportunity for local players like us. It is expected that capex spending will continue its upwards trend in 2024, surpassing pre-pandemic levels, on the heels of the massive under-investment throughout the past few years. This will reflect well on shipping sector.

The OSV sector has been waiting a long time for the tide to turn after a slump of many years. The time appears to be now, as oil majors globally ramp up their capital expenditure investment, especially for offshore activities, increasing the demand for OSVs. OSV is one of the most essential segments for offshore activity. Not only that, the global shortage of vessels has moved charter rates to levels that would put a smile on the faces of OSV owners. Spot charter rates have risen by 10% to 20% in 2023, a similar quantum of increase that was seen in 2022. We believe that charter rates will continue to rise this year as OSV supply remains limited. This means that the OSV sector, which saw low charter rates crimp profitability, will see brighter days ahead. Activity is picking up in other parts of the world due to many years of underinvestment. In Malaysia, the PAO has indicated a brighter outlook for the OSV segment as well. The PAO also forecasts that the number of vessels to support drilling and projects will increase 29% to 249 in 2024 from 193 in 2023 while the number of vessels supporting production operations is expected to increase to 148 from 144. The higher demand in 2024 mainly comes from anchor handling tug and supply ("AHTS"), platform supply vessels/straight supply vessels ("PSV") and work barges. AHTS vessels are expected to drive the majority of this demand increase, followed by PSVs. This positive outlook for OSV owners is further reinforced by the expected tight supply of vessels both locally and globally due to limited investments in new vessels in recent years. We believe that this will improve our overall vessel utilisation as well.

Underspending by OSV due to environmental, social and governance ("ESG") initiatives have constrained new builds for OSV, resulting in a significantly reduced supply of vessels in the market. This bodes well for existing OSV owners with working assets due to lack of alternatives. In addition, there have been no new-build orders for new assets since 2019 owing to uncertainties. Furthermore, no major player has announced fleet expansion plans, which further reinforces the expectation that the spot charter rates market is expected to strengthen with an increase in upstream spending.

The O&G industry is expected to have a steady start for the year 2024 based on last year's trend where the Brent crude oil price traded between US$70 and US$90 per barrel("bbl"). The US Energy Information Administration (EIA) forecasts the Brent crude oil spot price will increase to an average of US$84/bbl in first-half 2024, partly driven by recently announced OPEC+ production cuts. The EIA expects the Brent spot price will average US$83/bbl in 2024.

Discussions are continuing on the replacement of older fleet with newbuilds. Others are taking delivery of new vessels while disposing older smaller ones in similarly heated markets like India and the Middle East. This as they prepare for Petronas upcoming production operations vessels ("POV") tender, for which awards have been delayed since end of last year. These POV awards are expected to be 3+3 years' contract awards for around 145 vessels across different sub-segments, with total contract value of more than RM2 billion per year. Beyond that, the industry is also anticipating the second phase of the Safina newbuild programme, a build-to-operate contract award first introduced by Petronas in 2021. The first phase of 2021 saw contracts with a long-term charter period of 7+3+3+2 years (a total of 15 years) awarded. However, only 11 vessels were built locally under the first phase, out of the 16 tendered (and approximately 100 projected across the entire five-year programme), suggesting that there is still a big slice of the pie to be given away. Phase two of Safina is expected to be tendered as early as the third quarter of this year. Industry estimates for the awards range from the teens to more than 20 vessels. The local industry prioritises Malaysian-flagged vessels.

OVERVIEW OF THE GROUP'S BUSINESS AND OPERATIONS

The Group is principally involved in the business of chartering of marine vessels, shipbuilding and ship repair. The Group builds, owns and operates a diverse fleet of marine support vessels, which serve the global exploration and marine industry.

Our shipyard is located in Kuala Baram, Miri, Sarawak and the workshop in Krokop Miri, Sarawak. Our shipyard delivered its first new build in 1999, a landing craft known as "Sealink Victoria". To-date, our shipyard has constructed in total sixty-eight (68) vessels (including fabrication of two work barges). The Group's shipbuilding division will also continue its emphasis on ship repair. Apart from construction of OSVs, the Group has diversified into the construction of harbour tugs and other non-oil and gas vessels. Armed with technical knowhow and management capabilities, our Group is able to offer a sophisticated array of vessels designed to meet our customers' needs.

Our ship operations are based in Miri, Sarawak with branch offices located in Labuan, Kemaman and Singapore. The shipping division has a fleet of twenty-two (22) vessels providing a broad range of services to the marine sector with the highest standards of safety and technology available in the industry.

Over the years, the Group has established a reputation with a proven track record in both of our core businesses. As a testimony to this, our clientele includes both local and international companies from the United States of America, Australia, China, Latin America, Europe, East Africa, Southeast Asia and the Middle East.

As an integrated service provider, we have full discretion and control over the design specification, quality, cost and timely delivery of our vessels. It also provides us with the flexibility to either "build and sell" or "build and charter" our vessels. Our experienced maintenance team can respond promptly and attend to emergency repairs and where necessary, vessel(s) can be arranged to be up slipped internally at our slipway in Kuala Baram for vessels within the vicinity. This reduces our dependence on other yards and provides our Group with a distinct competitive advantage over the other players in the market

The Group strives to intensify its efforts and commitment to deliver high value products and services with emphasis on safe operations and to maintain the group's position as one of the leading integrated service providers in the offshore marine services segment.

As a key measure to manage the Group's exposure to the business risks, the Group has continued on the following initiatives which have been reinforced and carried forward to the next financial year:

- Sustainable cost rationalisation and optimisation of human resources where only critical positions are filled when incumbents leave the Group. Existing personnel are re-deployed within the Group to take on additional responsibilities for better efficiencies without impairing the adequacy of existing internal control system;

- Closer monitoring of inventory management, where stringent controls have been deployed to account for procurement of goods and of services vis-à-vis existing inventory levels to conserve cash flows and minimise the risk of inventory obsolescence; and

- Effective cash flow management.

The Group is recognised as a reliable and respected player in the O&G sector, owing to our commitment to several key principles. We prioritise maintaining our core business and safeguarding our assets to ensure a steady stream of positive cash flow. Our focus on achieving robust operational benchmarks, fulfilling our promises, adhering to best practice corporate governance standards, and embodying responsible corporate citizenship further solidifies our reputation. Looking ahead, our goal is to continually bolster our business standing while remaining vigilant against potential risks. We are dedicated to prioritising health, safety, security and environmental considerations, considering they remain paramount in all our endeavours.

The Group has won various contracts from national and international oil majors in Malaysia and abroad. We are still striving for better market reach and branding, with the view of enhancing shareholder value. The ability to win contracts reaffirmed the trust, confidence and support of our esteemed clients. We are now ready to embark on long-term growth plans to further maximise shareholder value given our more efficient capital structure. We remain confident that we should be able to reward our faithful shareholders who have remained steadfast with us throughout this journey.

OVERVIEW OF FINANCIAL PERFORMANCE

Financial results

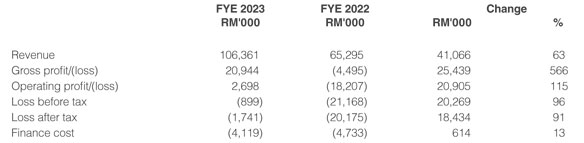

In FYE 2023, the Group achieved an improvement in operational performance. The Group recorded a revenue of RM106 million, representing a RM41 million or 63% increase as compared FYE 2022. The significant improvement in the revenue was attributable to the higher utilisation of vessels.

Corresponding to the higher revenue, the Group recorded a gross profit of RM20.9 million in FYE 2023 as compared to a gross loss of RM4.5 million in FYE 2022.

The operating profit was in tandem with higher revenue and utilisation of vessels.

Finance cost had also reduced from RM4.7 million in 2022 to RM4.1 million in 2023 as certain loans have been paid off.

Liquidity and resources

The Group monitors and manages its cash flows effectively and ensures all obligations and funding needs are met as and when they fall due. A critical component of the Group's ability to persevere through the global economic, pandemic and industry challenges of the past few years has been our prudent and disciplined financial management. We have further strengthened our liquidity position, as cash and bank balances increased by more than doubled from RM7 million to RM23 million for the FYE 2023. This increase was attributed to the increase in cash caused by operating activities which contributed to the overall positive cash flow. We have significantly improved cash collection from customers through our diligent follow-up. Our positive liquidity position reflects our ability to meet our financial obligations including capex, working capital and debt repayments.

We have reduced the group's term loans significantly from RM19 million in 2022 to about RM10 million in 2023, a reduction of about 47%. Presently, only one (1) vessel out of our charter fleet of twenty-two (22) is encumbered. This speaks well of the viability of the Group's business. At the same time, with reduced gearing the Group will have a stronger balance sheet to take on additional financing to fund expansion when opportunities arise. Despite the loss for the year, there is a surplus in the cash flows generated from operations amounting to about RM29 million. Our conservative management of debt is reflected in our low gearing and effective risk management strategies put us in a positive financial position to compete for jobs and execute them effectively.

Capital Management

We are committed to pursuing excellence in deciding how capital is allocated to maximise returns and balance the risks and opportunities of investment. As we strive to provide long-term value for our stakeholders, we adopt a cautious yet strategic approach to capital management, prioritising investments that offer favourable risk-return profiles and align with our long-term growth objectives. We mitigate the economic risks through careful consideration of maintaining a balanced capital structure. Our capital allocation decisions allow us to optimise the Group's financial resources, bolster expansion strategies and generate sustainable value for our shareholders. We remain vigilant in monitoring and refining our capital management practices to accommodate evolving market dynamics and potential opportunities. We prioritise prudent capital management by making informed investment decisions. We are committed to ensuring that our capital expenditures are backed by substantial and secure contracts, avoiding speculative ventures. Management monitors capital based on the Group's gearing ratio. The Group's strategy is to maintain a gearing ratio not exceeding 100%. The gearing ratio is calculated as total loans and borrowings divided by equity capital. The ratio for the Group has improved from 27% in 2022 to 19% in 2023.

Dividend

The declaration and payment of dividend will depend upon the Company's financial performance, cash requirements and is subject to certain limitations imposed under the Companies Act 2016. Due to the aforesaid losses incurred, the Board does not recommend any dividend for the FYE 2023.

Corporate Social Responsibility

The Group is continuously committed to fulfilling our role as a responsible corporate social citizen. The main focus of our Group on corporate social initiatives are the Workplace, the Environment and the Community, with the view of maintaining a sustainable value for the Group and its shareholders. Activities undertaken of the Group's corporate social responsibilities are set out separately in the Sustainability Statement.

Corporate Governance

The Board believes in embedding a culture in the Group that seeks to balance compliance requirements with the need to deliver long-term strategic value to shareholders and stakeholders through performance, predicated on entrepreneurship, control and ownership, and with due consideration towards ethics and integrity. As such, the Board strives to embrace the substance behind the Principles and Recommendations as promulgated by the Malaysian Code on Corporate Governance 2021 and not merely the form.

Apart from the disclosures in the Annual Report, the Group has also established a corporate website at www.asiasealink. com that houses, inter-alia, documentation on the Group's corporate governance practices like the Board Charter, Whistleblower Policy, Code of Conduct/Ethics for Directors and employees of the Group, Corporate Disclosure Policies and Procedures Documents, Sustainability Policy, Gender Diversity Policy, Fit and Proper Policy and Anti-Bribery & Corruption Policy that are useful for investors as well as potential investors to be apprised on how the Board views corporate governance and engagement with investors. The website also provides, amongst others, information deemed pertinent for investors and the public, for example the Company's corporate announcements, financial results and historical chart of the Company's share prices.

OUTLOOK AND PROSPECTS

The Group holds a positive outlook about its prospects, anticipating improved results driven by increasing demand for our vessels. Our ongoing strong momentum and customer demand, as evidenced by our results, underpin this optimism. This favourable outlook bodes well for the Group's financial performance.

We believe that 2024 holds promise for the O&G industry, aligning with the positive outlook expressed by Petronas regarding the sector's prospects. We are confident that the demand for OSVs will persist and strengthen throughout the year.

The Group remains focused on its core operations of ship chartering, ship repair and shipbuilding. The shipbuilding division will prioritise constructing vessels catering to niche markets and upgrading its docking facilities for ship repair. Concurrently, efforts will be directed towards maximising the utilisation of the Group's vessels. Additionally, the Group aims to develop new vessels with enhanced energy efficiency and environmental friendliness, aligning with the increasingly stringent environmental standards in the maritime sector.

With a solid history in marine transportation, offshore support services, shipbuilding and ship repair, we are committed to actively seeking out new opportunities. Moving ahead, we will capitalise on our resources and assets, emphasising capacity building, enhancing operational efficiencies and deploying cost-cutting measures to foster sustainable, longterm growth.

NOTE OF APPRECIATION

On behalf of the Board, I wish to express our sincere thanks and appreciation to our management and staff for their dedication and hard work in helping the Group overcome challenges during the past year and emerge even stronger. I would also like to extend our heartfelt thanks to our esteemed customers, business partners, bankers and suppliers for their unrelenting support and confidence in us. I am extremely grateful to you, our shareholders, for standing steadfast with us amidst uncertain times, and seek your continuous support, as we look forward to achieving even greater milestones in the year ahead. Let us maintain our commitment to steer towards greater heights in the future together. It is our sincere hope that Sealink will continue to grow from strength to strength in the coming years and beyond.

Last but not least, my special thanks to my fellow Directors on the Board for their invaluable support and guidance throughout the financial year. Thank you.

Thank you.

YONG KIAM SAM

Chief Executive Officer cum Managing Director