Subscribe Email ALerts, you may automatically receive Sealink International Berhad newly posted announcements.

Select and download files from our Download Library to have your own IR Kit

Financials

Financials

Quarterly Report For The Financial Period Ended 30 September 2024

Financials Archive![]() Note: Files are in Adobe (PDF) format.

Note: Files are in Adobe (PDF) format.

Please download the free Adobe Acrobat Reader to view these documents.

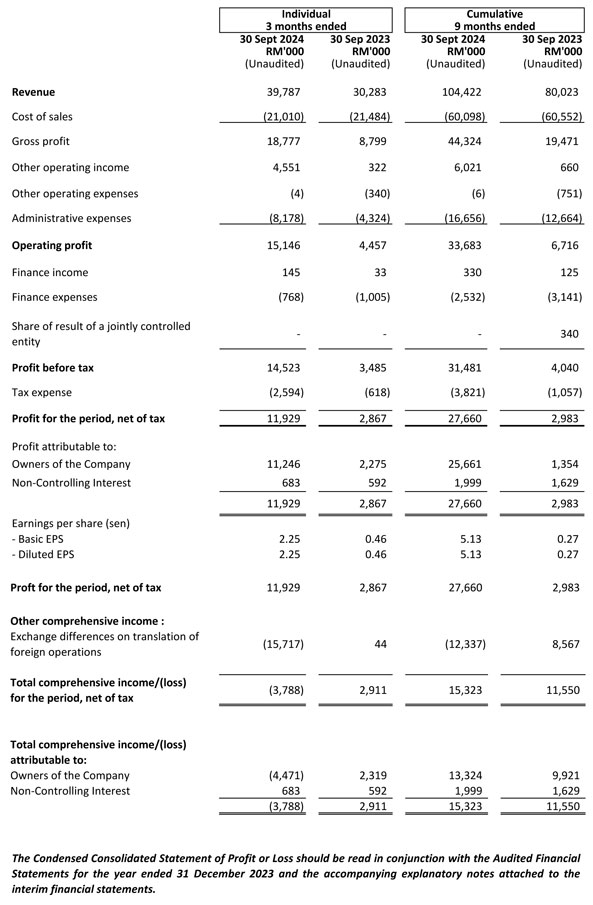

Condensed Consolidated Statement Of Profit Or Loss

For The Quarter And Year-To-Date Ended 30 September 2024

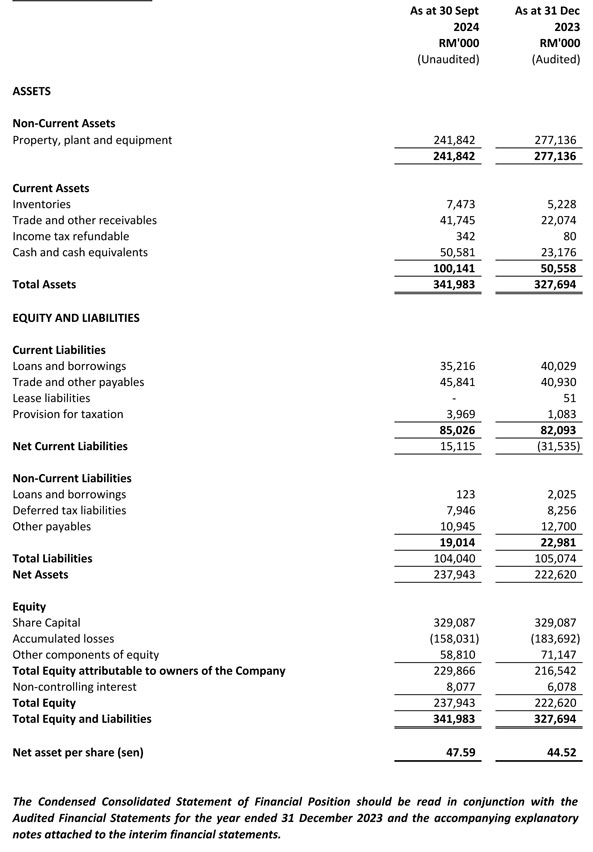

Condensed Consolidated Statement Of Financial Position

As At 30 September 2024

Review of performance of the Company and its principal subsidiaries

(a) Financial review for current quarter and financial year to date

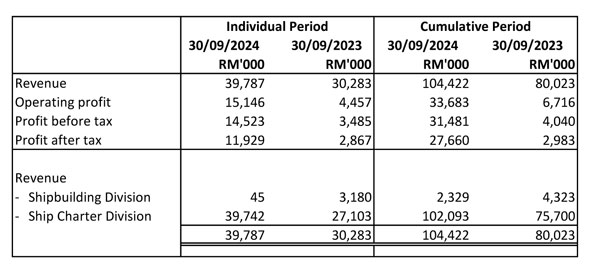

OPERATING SEGMENTS REVIEW

3Q 2024 vs 3Q 2023

(I) Operating Revenue

The Group's revenue for the current quarter ended 30 September 2024 achieved at RM104m which was increased by RM24m or 30% as compared to the previous corresponding quarter ended 30 September 2023. The increase in revenue was mostly attributed from ship charter division which was due to higher utilisation of vessel and improved charter rate.

The current quarter has achieved a profit before tax of about RM15m as compared to RM3.5m in the preceding quarter due higher profit from ship chartering division.

Chartering Division

The higher revenue for Chartering division in the current period compared to the corresponding period ended 30 September 2024 was mainly due to higher vessel utilisation and improved charter rate.

Shipbuilding Division

In the current period, Shipbuilding division's revenue recorded at RM45k as compared to the revenue recorded in the corresponding period ended 30 September 2023 of RM3.1m. The decreased in revenue for shipbuilding division was due to ship repair activities were mainly servicing own vessels.

Commentary on prospects

The Group holds a positive outlook about its prospects, anticipating improved results driven by increasing demand for our vessels. Our ongoing strong momentum and customer demand, as evidenced by our results, underpin this optimism. This favourable outlook bodes well for the Group's financial performance. The Group has achieved a profit after tax of RM11.9 million in this quarter.

We believe that 2024 holds promise for the O&G industry, aligning with the positive outlook expressed by Petronas regarding the sector's prospects. Based on the recent release of the Petronas Activity Outlook 2024-2026, the activity outlook for Petronas remains positive, in line with the continued recovery that we have seen throughout 2023. Specifically, Petronas mentioned that this is positive for activities relating to repair and maintenance activities required to maintain the integrity of offshore facilities. With this, the demand for OSVs is expected to remain steady going into 2024, especially for vessels supporting drilling and wells projects. It sees higher demand of OSVs in 2024-2026 compared with its previous forecast and this is an opportunity for local players like us. It is expected that capex spending will continue its upwards trend in 2024, surpassing prepandemic levels, on the heels of the massive under-investment throughout the past few years. This will reflect well on shipping sector.

We are confident that the demand for OSVs will continue to strengthen throughout this year. Just as encouraging as the acceleration in demand for OSVs is the continued reduction in the available supply of OSVs. The number of OSVs currently available is very limited indicating that the supply of vessels will continue to decline gradually. Accordingly, it is our view that the industry is positioned to benefit from an increase in demand over medium to long term with a slowly shrinking supply of vessels. We believe this imbalance in supply and demand will continue to provide the opportunity for day rate and utilisation to increase.

We have reduced the group's term loans from RM10 million in December 2023 to about RM3.4 million in September 2024, a reduction of about 66%. This speaks well of the viability of the Group's business. At the same time, with reduced gearing the Group will have a stronger balance sheet to take on additional financing to fund expansion when opportunities arise.

The Group remains focused on its core operations of ship chartering, ship repair and shipbuilding. The shipbuilding division will prioritise constructing vessels catering to niche markets and upgrading its docking facilities for ship repair. Concurrently, efforts will be directed towards maximising the utilisation of the Group's vessels. Additionally, the Group aims to develop new vessels with enhanced energy efficiency and environmental friendliness, aligning with the increasingly stringent environmental standards in the maritime sector.

We are looking forward to secure more new charters. We have already embarked on initiatives to enhance our bidding competitiveness. These will augment our business and operational resilience and help us deliver projects in line with our customers' needs and expectations. The Group will continue to pursue and seek opportunities to achieve a better financial performance this year. Moving forward, we will leverage our strengths and improve efficiency to achieve better results for the Group.